Understanding the complexities of health insurance can be overwhelming, especially when it comes to distinguishing between co-pays and deductibles. These two terms represent core components of your health insurance cost structure, yet many policyholders remain unclear on their precise differences. In this comprehensive guide, we’ll explore the definitions, comparisons, examples, and financial implications of co-pays and deductibles, empowering you to make informed healthcare decisions.

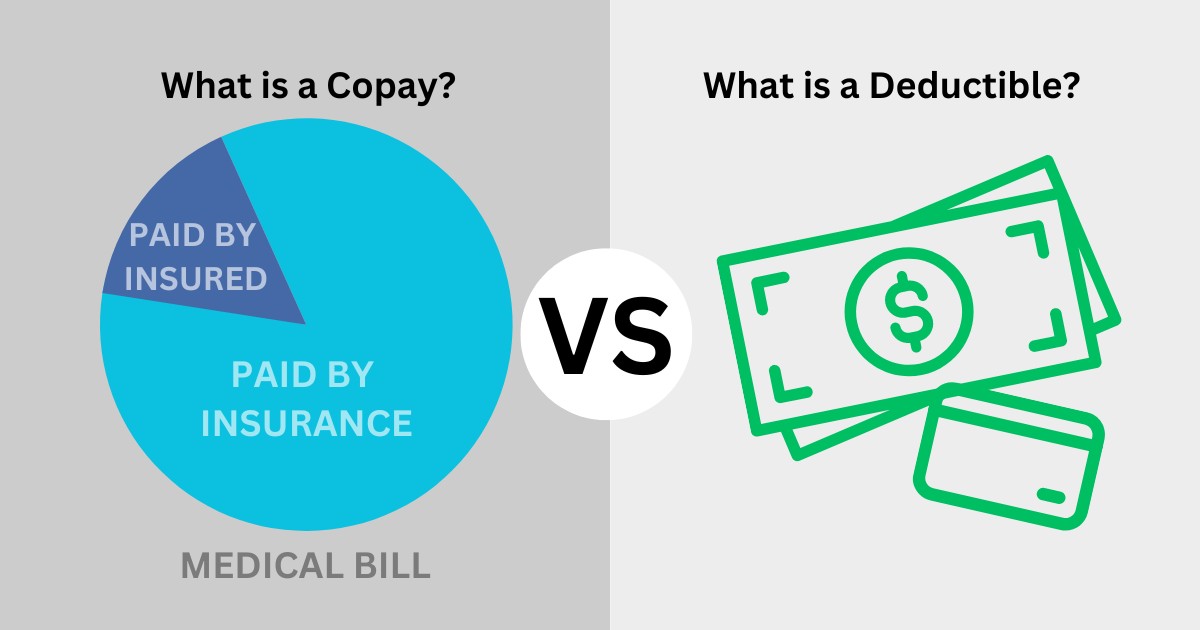

What Is a Co-Pay?

A co-pay, short for co-payment, is a fixed amount you pay for a covered healthcare service at the time you receive it. This fee is usually predetermined by your insurance policy and varies depending on the type of service.

Key Characteristics of Co-Pays

- Flat Fee: Commonly $10-$50 per visit or service.

- Applies Immediately: You pay the co-pay even if you haven’t met your deductible.

- Service-Specific: Co-pays differ for visits to primary care physicians, specialists, urgent care, or emergency rooms.

- Separate From Deductible: Co-pays typically do not count toward your deductible unless your policy explicitly states otherwise.

Example: If your insurance plan lists a $30 co-pay for a general doctor visit, you’ll pay $30 at the time of your appointment regardless of whether you’ve met your deductible.

What Is a Deductible?

A deductible is the amount you must pay out-of-pocket each year before your insurance company starts to pay for most covered services.

Key Characteristics of Deductibles

- Annual Requirement: Resets each year.

- Higher Cost Than Co-Pays: Deductibles often range from $500 to several thousand dollars.

- Affects Overall Coverage: Until the deductible is met, you bear the full cost of care (excluding co-pays and preventive services).

- Essential for Major Care: Deductibles are especially relevant for hospital visits, surgeries, diagnostics, and specialist care.

Example: If your deductible is $2,000, you must pay $2,000 in eligible medical expenses before your insurance begins to cover most of your costs.

Key Differences Between Co-Pay and Deductible

| Aspect | Co-Pay | Deductible |

|---|---|---|

| Type of Payment | Fixed fee per service | Accumulated annual out-of-pocket amount |

| When Paid | At the time of service | Until threshold is met, before coverage |

| Typical Cost | $10 – $50 | $500 – $5,000+ |

| Resets | Per visit | Annually |

| Coverage Start | Immediate | After deductible is met |

| Applies to All Plans | Most plans | All plans |

How Co-Pays and Deductibles Work Together

Both co-pays and deductibles are used to share healthcare costs between the insurer and the insured. Depending on your specific plan, some services require co-pays before or after meeting your deductible.

Scenario Example

Imagine you have:

- A $1,500 deductible

- A $25 co-pay for doctor visits

- You visit a primary care doctor: Pay $25 co-pay. The rest is covered.

- You require a specialist test costing $1,200:

- If you haven’t met your deductible, you pay $1,200.

- The amount contributes toward your deductible.

- Later in the year, you have another $500 procedure:

- You’ve now met the $1,500 deductible.

- Your insurance starts covering a larger share, often 80%-100%, depending on your plan.

Understanding Co-Insurance and Out-of-Pocket Maximums

Beyond co-pays and deductibles, it’s essential to grasp co-insurance and out-of-pocket maximums:

Co-Insurance

This is the percentage you pay after meeting your deductible. For example, with 20% co-insurance:

- A $1,000 procedure after deductible means you pay $200, insurer pays $800.

Out-of-Pocket Maximum

This is the maximum you’ll pay in a year for covered services. Once reached, the insurance covers 100%.

Includes:

- Deductibles

- Co-pays

- Co-insurance

Excludes:

- Premiums

- Non-covered services

Which One Costs More – Co-Pay or Deductible?

While co-pays are more predictable and typically lower, deductibles often result in higher upfront costs, especially for individuals with high-deductible health plans (HDHPs).

High Co-Pay Plans may work well for individuals needing frequent low-cost services.

High Deductible Plans are better suited for healthy individuals or those using Health Savings Accounts (HSAs) to offset upfront costs.

How to Choose the Right Health Plan Based on Co-Pay and Deductible

When selecting a health plan, assess your:

- Healthcare Usage: Frequent doctor visits? A plan with low co-pays might be ideal.

- Budget: Can you afford high upfront costs? If not, lower deductibles may be better.

- Chronic Conditions: Those with ongoing treatments may benefit from lower deductibles and consistent co-pays.

- Emergency Preparedness: High deductibles could lead to substantial bills in emergencies.

- HSA Eligibility: HDHPs with HSAs can offer tax benefits.

Frequently Asked Questions

Do co-pays count toward my deductible?

In most plans, co-pays do not count toward your deductible but may contribute to your out-of-pocket maximum.

Can I have both co-pays and deductibles?

Yes. Most insurance plans feature both, with co-pays for routine services and deductibles for major or specialist care.

What happens after I meet my deductible?

Once your deductible is met, insurance kicks in to cover a higher portion of your expenses. You may still pay co-pays or co-insurance until reaching your out-of-pocket maximum.

Conclusion: Why Knowing the Difference Matters

Choosing the right health insurance plan requires a solid understanding of both co-pays and deductibles. These cost-sharing mechanisms are central to how much you’ll pay out-of-pocket for care. Knowing the distinction helps you avoid unexpected expenses, plan for healthcare costs, and make smarter financial decisions.